Wage & Benefit Violations in New York: Know Your Rights as a Worker

Meta Description: Understanding your rights regarding wages and benefits in New York is crucial, especially in the construction and demolition sectors. Learn about common violations and how reputable companies like Alba Services prioritize fair compensation and compliance.

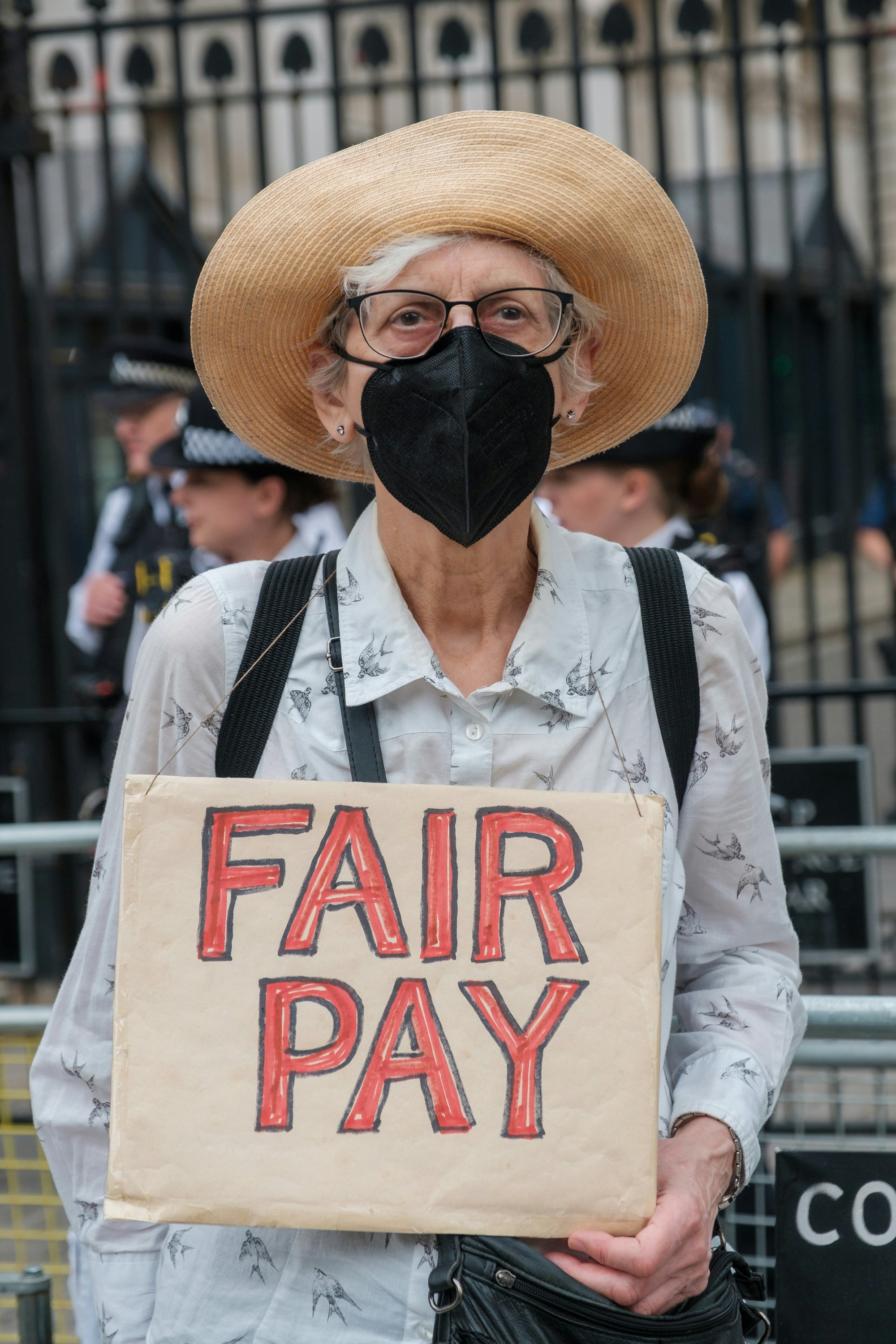

For countless workers across New York, the promise of fair wages and benefits is fundamental. However, in demanding industries like construction and demolition, instances of wage and benefit violations can unfortunately occur, undermining the livelihoods of dedicated individuals. Understanding your rights as an employee in New York State is not just empowering – it’s a vital step in ensuring you receive the compensation and benefits you’ve rightfully earned.

Reputable companies, like Alba Services, recognize that adhering to all wage and benefit laws is not merely a legal obligation, but a cornerstone of ethical business practice and a commitment to their workforce. They understand that a fairly compensated and well-supported team is essential for both success and safety in a challenging industry like demolition.

Understanding Wage & Benefit Laws in New York

New York State has robust labor laws designed to protect workers. Key areas of focus include:

-

Minimum Wage:

-

New York State mandates a minimum hourly wage. This rate can vary based on the region (e.g., NYC, Long Island, Upstate). Employers must pay at least this amount for all hours worked.

-

It’s important to differentiate this from prevailing wage, which applies to public works projects.

-

-

Overtime Pay:

-

For most non-exempt employees, New York State law generally requires overtime pay at 1.5 times their regular rate for any hours worked over 40 in a workweek.

-

Common violations include employers failing to pay overtime, misclassifying employees as “exempt” from overtime, or misclassifying them as “independent contractors” to avoid these obligations.

-

-

Prevailing Wage & Supplements (for Public Works):

-

This is particularly relevant in the construction and demolition industry, especially on public projects (e.g., state or city-funded initiatives).

-

Under New York State Labor Law, contractors and subcontractors on public work contracts must pay the prevailing wage and supplements (benefits) set for the locality where the work is performed. These rates are often significantly higher than standard minimum wage.

-

The New York State Department of Labor (NYSDOL) Bureau of Public Work and Prevailing Wage Enforcement publishes annual wage schedules that outline these rates for various job classifications (e.g., “Skilled Interior Demolition Laborer,” “General Interior Demolition Laborer”).

-

“Supplements” refer to the employer’s contributions to employee benefits like health insurance, pension, vacation, and holiday pay. These are considered part of the prevailing wage package.

-

Certified Payrolls: Contractors on public work projects are required to submit certified payrolls, which document hours worked and wages/benefits paid to each worker, to ensure compliance.

-

-

Wage Supplements / Benefits:

-

Beyond prevailing wage, New York Labor Law also addresses employers’ obligations for benefits or wage supplements they agree to provide (verbally or in writing). This includes things like vacation pay, holiday pay, sick leave, and bonuses.

-

Employers are required to notify employees in writing or by publicly posting their policy on such benefits.

-

-

Illegal Deductions & Unpaid Hours:

-

Employers cannot make unauthorized deductions from your pay.

-

All hours worked must be compensated, including time spent preparing tools, traveling between job sites, attending mandatory meetings, or working during designated “breaks.”

-

Common Wage & Benefit Violations in Construction & Demolition

Workers in the construction and demolition sectors are particularly vulnerable to certain types of wage theft:

-

Underpayment of Prevailing Wage: Paying less than the required rate on public projects.

-

Misclassification:

-

Employee vs. Independent Contractor: Misclassifying an employee as an independent contractor to avoid paying taxes, overtime, workers’ compensation, and benefits.

-

Job Classification Misclassification: Paying a worker a lower prevailing wage rate by mislabeling their job role (e.g., paying a “skilled” laborer as a “general” laborer).

-

-

Unpaid Overtime: Failing to pay the time-and-a-half rate for hours over 40.

-

Off-the-Clock Work: Requiring workers to perform tasks before or after their official clock-in/out times without pay.

-

Falsification of Payroll Records: Submitting inaccurate payrolls to hide underpayments.

-

“Kickbacks”: Paying the correct wage then requiring workers to return a portion of it.

-

Failure to Pay Agreed-Upon Benefits: Not providing promised vacation, sick, or holiday pay.

How Reputable Companies Like Alba Services Ensure Compliance

Responsible demolition companies understand that fair compensation and benefits are fundamental to attracting and retaining a skilled, motivated workforce. Alba Services, for example, is committed to upholding all New York State labor laws. While specific salary figures or benefits packages vary based on roles and individual contracts, their approach generally includes:

-

Competitive Compensation: Alba Services aims to offer competitive salaries based on experience, acknowledging the demanding nature of demolition work.

-

Benefit Contributions: According to general public information about the Alba Group (which can include various Alba entities), they typically offer contributions to benefits such as health benefits and 401K retirement plans with company matching, along with paid time off. This demonstrates a commitment to employee well-being beyond just hourly wages.

-

Compliance with Prevailing Wage: For any public works projects they undertake, Alba Services is diligent in adhering to prevailing wage laws, including both hourly rates and supplemental benefits, ensuring all employees receive their due.

-

Transparent Record-Keeping: Reputable companies maintain accurate and transparent payroll records, which are critical for both internal accountability and external audits by labor authorities.

-

Professional Work Environment: Beyond compensation, Alba Services emphasizes creating an energetic, focused, and collaborative work environment, valuing its employees as integral to its success.

Your Rights & How to Report Violations

If you believe you have been subjected to wage or benefit violations in New York, you have rights and avenues for recourse:

-

Keep Records: Document everything: hours worked (even “off-the-clock”), pay stubs, bank statements, employment contracts, communications with supervisors, and the names of colleagues.

-

Contact Your Employer (If Comfortable): Sometimes, errors are unintentional and can be resolved directly.

-

File a Complaint with the NYS Department of Labor (NYSDOL): The NYSDOL investigates complaints regarding unpaid wages, withheld wages, illegal deductions, minimum wage, and overtime violations. You can file a Labor Standards Complaint Form (LS223).

-

Contact the NYC Comptroller’s Office: For prevailing wage violations on NYC public work projects, the Comptroller’s Office investigates and can recover underpaid wages.

-

Seek Legal Counsel: An attorney specializing in labor law can provide guidance and represent you in pursuing your claim.

Conclusion

Fair wages and benefits are not privileges, but fundamental rights for every worker in New York. While the construction and demolition industries are dynamic, the responsibility to comply with labor laws rests squarely with employers. Companies like Alba Services demonstrate that industry leadership extends beyond project execution to fostering a work environment where employees are valued, fairly compensated, and fully protected by law. By knowing your rights and the resources available, you contribute to a more equitable and just workforce for all.

Call to Action:

Looking for a demolition partner in New York City that prioritizes both project excellence and worker well-being? Learn more about the commitment to fair practices and comprehensive services offered by Alba Services. Visit albademo.com to explore their services, or contact them directly at 917-217-0459 or email info@albademo.com.